6 sales tax calculator

Springfield is located within Hampden. Our sales tax calculator will calculate the amount of tax due on a transaction.

6 Sales Tax Calculator Template

Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

. The calculator can also find the amount of tax included in a gross purchase amount. Calculating sales tax on a product or service is straightforward. Learn how to calculate sales tax by following these examples.

What is the tax on it and what is the total price including. This includes the rates on the state county city and special levels. In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Firstly if the tax is expressed in percent divide the tax rate by 100. Learn how Avalara can help your business with sales tax compliance today.

For a look at sales. Sales Tax Calculation To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that. Total CostPrice including ST.

Ad Solutions to help your business manage the sales tax compliance journey. To calculate the sales tax amount for all. While many other states allow counties and other.

Sales Tax Calculator. Tax 045 tax value. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

You can do this by simply moving the decimal point two spaces to the left. This will provide a combined sales tax rate for a location. Simply multiply the cost of the product or service by the tax rate.

For example if you operate your business in a. Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage. An alternative sales tax rate of 625 applies in the tax region.

Sales tax in Los Angeles in Los Angeles. Handbook of Mathematical Functions. To easily divide by 100 just move the decimal point two spaces to the left.

Pulte homes 3 carat oval. The average cumulative sales tax rate in West Springfield Massachusetts is 625. Now find the tax value by multiplying tax rate by the before tax price.

This includes the sales tax rates on the state county city and special levels. Enter the sales tax percentage. New Jersey has a 6625 statewide sales tax rate.

White frat boy names Search Engine Optimization. How to calculate sales tax from total. The West Springfield Massachusetts sales tax rate of 625 applies to the following two zip codes.

Sales tax is calculated by multiplying the. You can calculate the sales and use tax rate in your area by entering an address into our Sales Tax Calculator. West Springfield is located.

Tax 6 0075. 625 Is this data incorrect The Springfield Massachusetts sales tax is 625 the same as the Massachusetts state sales tax. In this example we do 625100 00625.

The average cumulative sales tax rate in Springfield Massachusetts is 625. 1 You buy a item on Ebay for 6 dollars and pay 75 percent in tax.

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Calculator Tax Vat And Gst Apps On Google Play

Sales Tax Calculator

5 3 Sales Tax Calculator Template Sales Tax Calculator Tax

Sales Tax Calculator

Sales Tax Calculator

How To Calculate Sales Tax Math With Mr J Youtube

How To Calculate Sales Tax

How To Calculate Sales Tax On Calculator Easy Way Youtube

Reverse Sales Tax Calculator

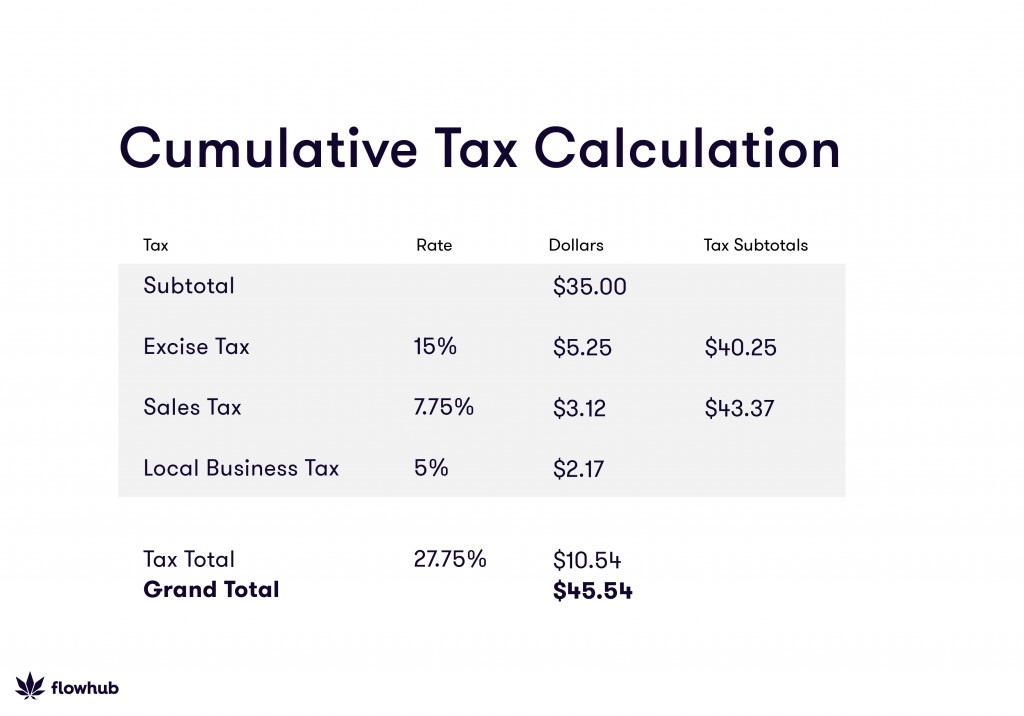

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Sales Tax In Excel Tutorial Youtube

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Tip Sales Tax Calculator Salecalc Com

How To Calculate Cannabis Taxes At Your Dispensary

Tax Schedules Templates

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com